What Is a Formulary, and Why Does It Matter?

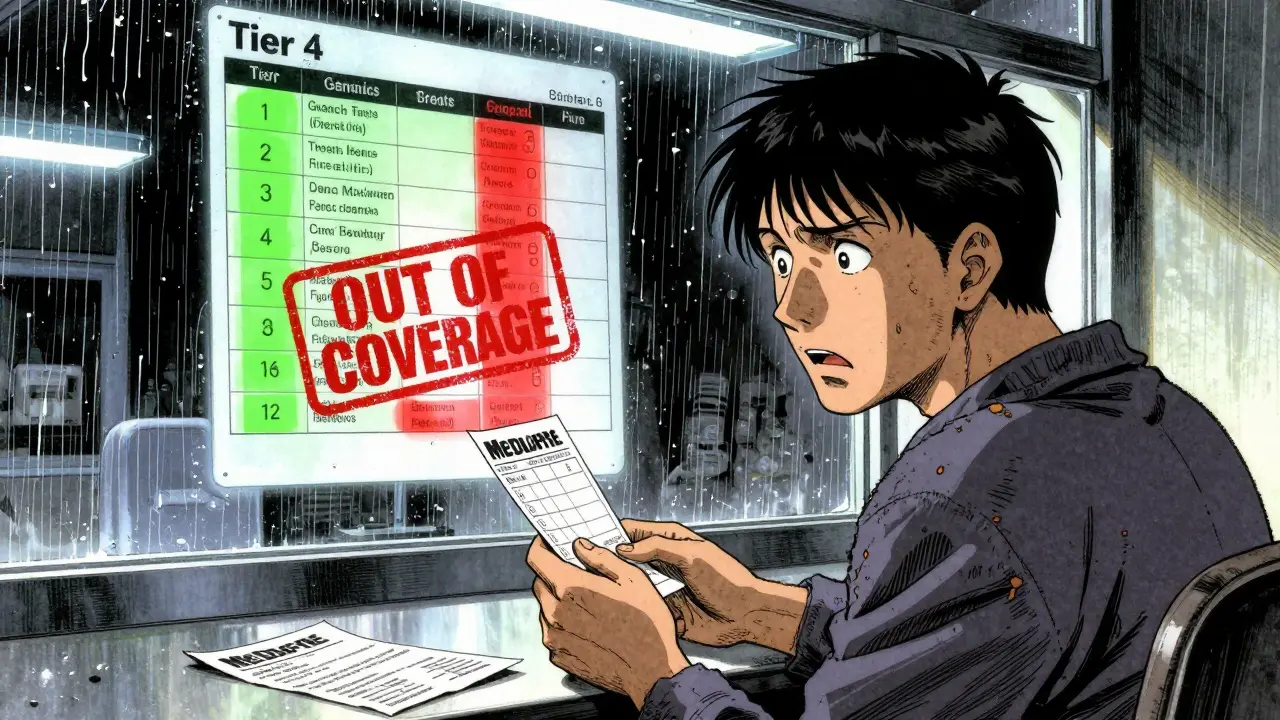

A formulary is a list of prescription drugs that your health insurance plan covers. It’s not just a catalog-it’s a decision-making tool that determines what medications you can get, how much you pay, and whether you need extra approval before filling a prescription. Most plans use a tiered system: Tier 1 includes low-cost generics, Tier 2 has preferred brand-name drugs, and higher tiers like Tier 3 or 4 include expensive specialty medications with much higher out-of-pocket costs. If your drug moves from Tier 2 to Tier 4, your monthly bill could jump from $30 to $300 overnight.

Formularies aren’t random. They’re managed by Pharmacy and Therapeutics (P&T) committees that review clinical data, cost-effectiveness, and rebates from drugmakers. These committees meet regularly-often quarterly-to decide which drugs stay, which go, and which move up or down tiers. In 2024, 92% of Medicare Part D plans and 87% of commercial plans used tiered formularies. That means if you’re on a typical plan, your medication’s coverage status can change without warning.

Why Do Formularies Change?

Formulary changes happen for three main reasons: cost, clinical evidence, and competition.

First, drug prices shift. A new generic might hit the market, making an older brand-name drug too expensive to justify keeping on a lower tier. Or a drugmaker might raise its price, prompting the insurer to push patients toward cheaper alternatives. Second, new studies come out. If a drug is found to have more side effects than previously thought-or if a better option becomes available-it may be moved down or removed entirely. Third, rebates matter. Drug companies pay insurers big money to be on the preferred list. If a competitor offers a bigger rebate, your drug could get bumped off the list-even if it’s working perfectly for you.

In 2023, a Health Affairs study found that patients forced to switch drugs due to formulary changes paid an average of $587 more per year out of pocket. That’s not just a number-it’s a real financial hit. And for people managing chronic conditions like diabetes, rheumatoid arthritis, or Crohn’s disease, a sudden switch can mean worse symptoms, hospital visits, or even treatment delays.

How Do You Know If Your Drug Is Affected?

You won’t always hear about it until you go to fill your prescription. But there are ways to stay ahead.

Medicare Part D plans are required to send you a notice at least 60 days before a formulary change takes effect. Commercial plans? Not so much. Many give only 22 days’ notice-sometimes less. That’s why checking your plan’s formulary every year during open enrollment is critical. Don’t wait for a letter. Log into your insurer’s website and search for your medication. Look for labels like “non-preferred,” “prior authorization required,” or “step therapy needed.”

Tools like Medicare’s Plan Finder and GoodRx’s formulary checker can help you compare coverage across plans. In 2023, 68% of Medicare beneficiaries used Plan Finder to compare drug costs. You should too. If your drug disappears from your plan’s list, you’ll need to act fast.

What to Do When Your Drug Is Removed or Moved

If your medication is taken off the formulary or moved to a higher tier, you have options.

- Request a formulary exception. You can ask your plan to cover your drug even if it’s not on the list. You’ll need a letter from your doctor explaining why the alternative drugs won’t work for you. In 2023, 64% of medically justified exceptions were approved by Medicare plans. For urgent cases, CMS requires plans to respond within 72 hours.

- Use manufacturer assistance programs. Many drugmakers offer co-pay cards or free medication programs for eligible patients. In 2024, these programs covered $6.2 billion in patient costs. For example, Humira patients whose coverage dropped saw their monthly cost jump from $50 to $650-many got help through AbbVie’s patient support program.

- Switch to a therapeutic alternative. If your drug is moved to a higher tier, ask your doctor if there’s another drug in the same class that’s still on your plan’s preferred list. For hypertension, there are often eight generic options. For diabetes, there are multiple GLP-1s and SGLT2 inhibitors with similar effectiveness. Don’t assume the next drug on the list is worse-ask your pharmacist to compare.

- Appeal the decision. If your exception request is denied, you can appeal. Medicare beneficiaries who used State Health Insurance Assistance Programs (SHIP) had a 37% higher success rate. These free services walk you through the paperwork.

Don’t stop taking your medication while waiting for approval. Ask your pharmacy if they can give you a temporary 30- to 60-day supply under the old formulary rules. Medicare and many commercial plans are required to allow this transition period.

How Providers Can Help You Stay Covered

Good doctors don’t just write prescriptions-they check coverage.

Large medical groups now use e-prescribing systems that check your plan’s formulary in real time before sending a prescription to the pharmacy. That means your doctor sees right away if your drug requires prior authorization or isn’t covered. In 2024, 76% of large practices used these tools. If your provider doesn’t, ask them to start. You can also ask for a 90-day supply of your medication to avoid frequent coverage checks.

Some clinics have formulary monitoring systems that alert them 60 days before changes. One nurse on AllNurses shared that her clinic uses this system to switch patients during routine visits-no disruption, no surprise bills. That’s the gold standard. Push your provider to adopt similar practices.

What’s Changing in 2025?

2025 brings major shifts in how formularies work.

The Inflation Reduction Act caps out-of-pocket drug costs for Medicare beneficiaries at $2,000 per year. That means plans can no longer use high tiers to shift costs onto patients. Expect to see fewer specialty tiers and more drugs moved into lower cost brackets.

Also, CMS is requiring all Medicare Part D plans to standardize formulary exception criteria by 2025. Right now, each plan has its own rules. That’s confusing. Standardization will make it easier to appeal decisions.

Another big change: accumulator adjustment programs. These programs, now used by 71% of commercial plans and 43% of Medicare Part D plans, stop manufacturer coupons from counting toward your deductible. So even if you get a $100 co-pay card, your plan doesn’t count it toward reaching your out-of-pocket maximum. That means you’ll pay more before your plan kicks in. Watch for this fine print.

How to Protect Yourself Going Forward

Here’s what you can do right now:

- Check your formulary every October, even if you’re happy with your plan.

- Keep a printed copy of your current drug list and tier status.

- Ask your pharmacist to review your coverage every time you refill.

- Sign up for email alerts from your insurer-they often notify you of changes before the mail does.

- If you’re on a specialty drug, contact the manufacturer’s patient support team. They often know about upcoming formulary moves before the public does.

And if you’re a caregiver or helping an older adult, don’t assume they understand the changes. A 2024 KFF survey found that 41% of Medicare beneficiaries were confused by their formulary tiers. Help them navigate it.

Final Thought: You Have Power

Formularies are designed to save money-but they shouldn’t cost you your health. You’re not powerless. You can request exceptions, switch drugs wisely, use manufacturer help, and appeal denials. The system isn’t perfect, but it’s not unbreakable either. Stay informed. Ask questions. Advocate for yourself. The right medication shouldn’t come with a financial trap.

What should I do if my drug is removed from my formulary?

First, don’t stop taking your medication. Contact your pharmacy to see if you can get a 30- to 60-day transition supply. Then ask your doctor to file a formulary exception request with your insurer, explaining why alternatives won’t work. You can also explore manufacturer assistance programs or switch to a covered alternative. If your request is denied, you can appeal the decision-Medicare beneficiaries who use State Health Insurance Assistance Programs (SHIP) have a 37% higher approval rate.

How much notice do insurers have to give before changing my drug coverage?

Medicare Part D plans must give you at least 60 days’ notice before removing a drug or moving it to a higher tier. Commercial insurers are not required to give the same notice-many only provide 22 days or less. Always check your plan’s formulary annually during open enrollment and sign up for email alerts to catch changes early.

Can I switch plans mid-year because of a formulary change?

Generally, no-you can only switch Medicare Part D or Medicare Advantage plans during open enrollment (October 15 to December 7) or during a Special Enrollment Period. But if your drug is removed entirely and you’re on a Medicare plan, you qualify for a Special Enrollment Period. For commercial plans, check your policy: some allow mid-year changes if your medication is no longer covered. Always contact your insurer to confirm.

Why do some drugs require prior authorization?

Prior authorization means your insurer wants proof that you’ve tried cheaper alternatives first or that the drug is medically necessary. This is common for specialty drugs-73% of them require prior authorization. It’s a cost-control tool. Your doctor must submit clinical documentation to justify the need. If approved, your drug will be covered. If denied, you can appeal.

Are generic drugs always cheaper than brand names on formularies?

Usually, yes-but not always. Sometimes a brand-name drug has a larger manufacturer rebate, so the plan puts it on a lower tier than a generic. Always check the actual cost at the pharmacy-not just the label. Use GoodRx or your plan’s formulary tool to compare prices. A generic might cost $15, but a brand with a coupon could be $10.

Dikshita Mehta

December 20, 2025 AT 03:12Formulary changes are a silent crisis for chronic illness patients. I’ve seen friends with rheumatoid arthritis get switched from Humira to a biosimilar that didn’t work-then spent six months fighting for an exception. The system assumes you have time, energy, and medical literacy. Most don’t. Always keep a printed copy of your current formulary. Email alerts? Too late. Check your plan’s website every October, even if nothing seems wrong. You’re not paranoid-you’re prepared.

pascal pantel

December 22, 2025 AT 00:26Let’s be real-formularies are just cost-shifting mechanisms disguised as clinical decision-making. P&T committees don’t care about your quality of life, they care about rebate percentages. That ‘step therapy’ requirement? It’s a bottleneck designed to make you suffer until you give up. And don’t get me started on accumulator adjustment programs-those are pure corporate fraud. Insurance companies are literally stealing your manufacturer discounts. This isn’t healthcare. It’s a financial extraction racket.

Gloria Parraz

December 22, 2025 AT 10:43I work with seniors who rely on insulin. One woman cried because her plan moved her to a higher tier and she had to choose between her medication and groceries. This isn’t policy-it’s cruelty wrapped in bureaucracy. Please, if you’re reading this and you’re healthy: don’t wait until it happens to you. Call your rep. Ask your doctor to use e-prescribing tools that check formularies in real time. Advocate. Share this post. The people who are getting crushed right now? They didn’t ask for this.

Sahil jassy

December 23, 2025 AT 19:10Janelle Moore

December 25, 2025 AT 13:32Did you know that drug companies secretly pay insurers to kick off cheaper generics? I found a leaked internal memo from Express Scripts showing they pushed out a $4 generic because a brand paid $12 million in rebates. And now they’re telling us it’s ‘clinical evidence’? Liar. The Inflation Reduction Act? It’s a distraction. They’ll just invent new tiers or add ‘specialty utilization management’ to bypass it. They’re always one step ahead. You think you’re protected? You’re not.

Chris porto

December 26, 2025 AT 00:45It’s strange how we treat medicine like a commodity. We don’t negotiate with our heart surgeon over which scalpel they use. But somehow, a $300 insulin pen becomes a ‘cost-efficiency’ problem. The real issue isn’t the formulary-it’s that we’ve outsourced healthcare decisions to profit-driven algorithms. We need to ask: who benefits when a diabetic can’t afford their meds? And why do we accept that as normal?

Ryan van Leent

December 26, 2025 AT 14:37Adrienne Dagg

December 26, 2025 AT 18:34My mom got switched from her diabetes med last year and the pharmacy told her ‘it’s cheaper now’-but she ended up in the ER because her blood sugar went haywire. 🥲 Don’t let them gaslight you. If your body reacts to a new drug, it’s not ‘adjusting’-it’s failing. Use SHIP. Use patient programs. Use GoodRx. And if your doctor doesn’t check your formulary? Find a new one. Your life > their convenience.

Erica Vest

December 28, 2025 AT 18:20For anyone considering a formulary exception: make sure your doctor’s letter includes specific clinical details-not just ‘this drug works for me.’ Mention lab values, previous failed alternatives, and documented adverse reactions. Medicare reviewers look for objective evidence. Also, submit the request immediately after the notice, not after you’ve already been denied at the pharmacy. Timing matters. And if you’re on a commercial plan, don’t assume you have the same rights as Medicare-you don’t. Document everything.